Simplify Your FIX Protocol Connectivity for Buy-Side and Sell-Side Firms

Smart FIXGate is a powerful, self-managed FIX connectivity platform designed to empower both buy-side and sell-side firms. Whether you’re an asset manager, broker-dealer, hedge fund, or market maker, Smart FIXGate automates your FIX protocol routing, streamlines risk management, and enhances trading efficiency across global markets.

With built-in monitoring, advanced automation, and dynamic risk controls, Smart FIXGate puts you in full control of your FIX trading infrastructure.

Smart FIXGate Overview

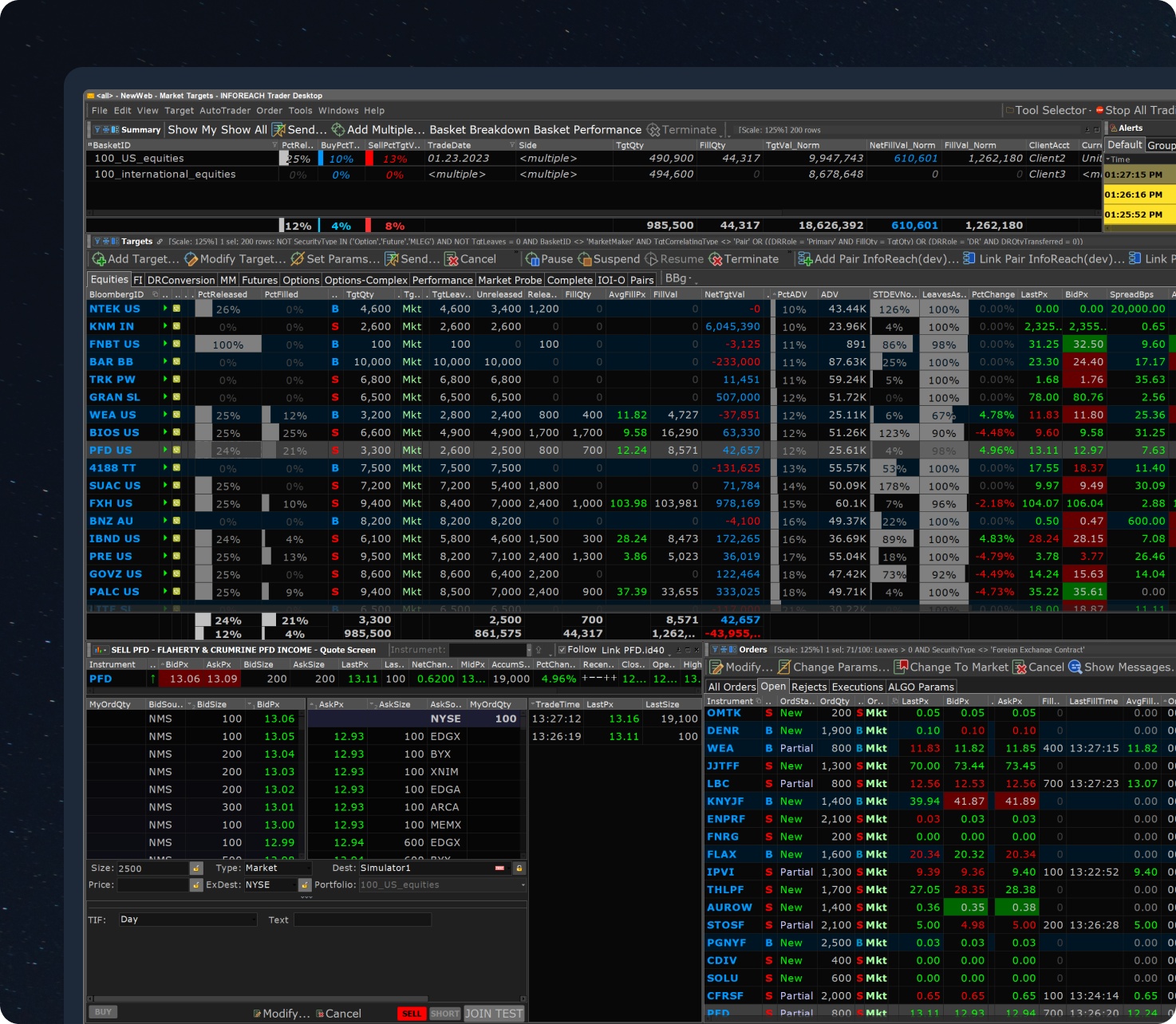

Smart FIXGate is an automated and highly configurable FIX protocol order router, engineered to process high volumes of transactions with ultra-low latency. Designed for both buy-side and sell-side firms, Smart FIXGate simplifies and consolidates broker connectivity across multiple trading platforms into a single, enterprise-grade solution that also functions as a trade risk and compliance manager.

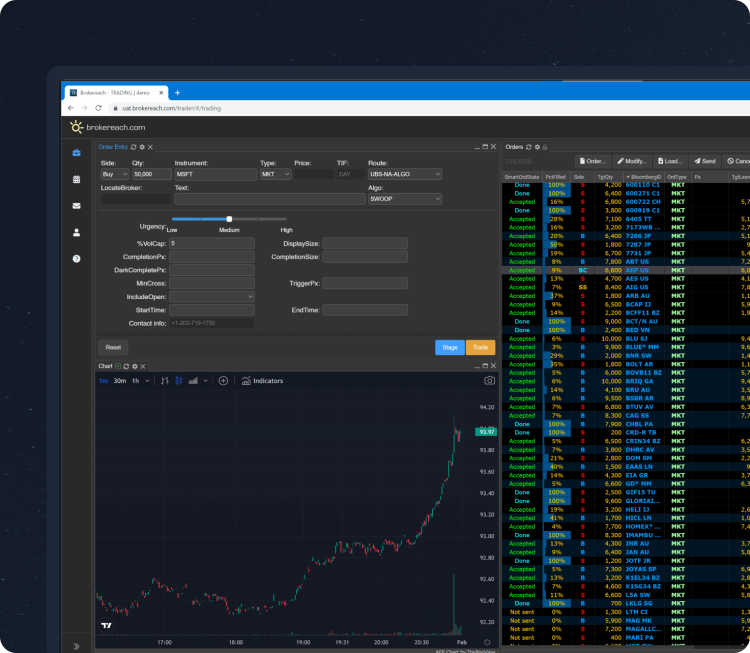

For buy-side firms, Smart FIXGate centralizes FIX connectivity, ensuring streamlined access to a diverse broker network through one robust platform. For sell-side firms, it standardizes FIX message flows from various client trading systems, using advanced, rule-based routing to direct orders to brokers’ trading desks, algorithmic execution engines, or directly to global trading venues.

Built entirely in Java, Smart FIXGate is a scalable and flexible order and execution management platform. Its core infrastructure includes a high-performance FIX engine, rule-based message router, security master resolver, message normalizer, position tracker, and real-time risk monitoring modules. This powerful architecture enables reliable and efficient order flow management in demanding trading environments.

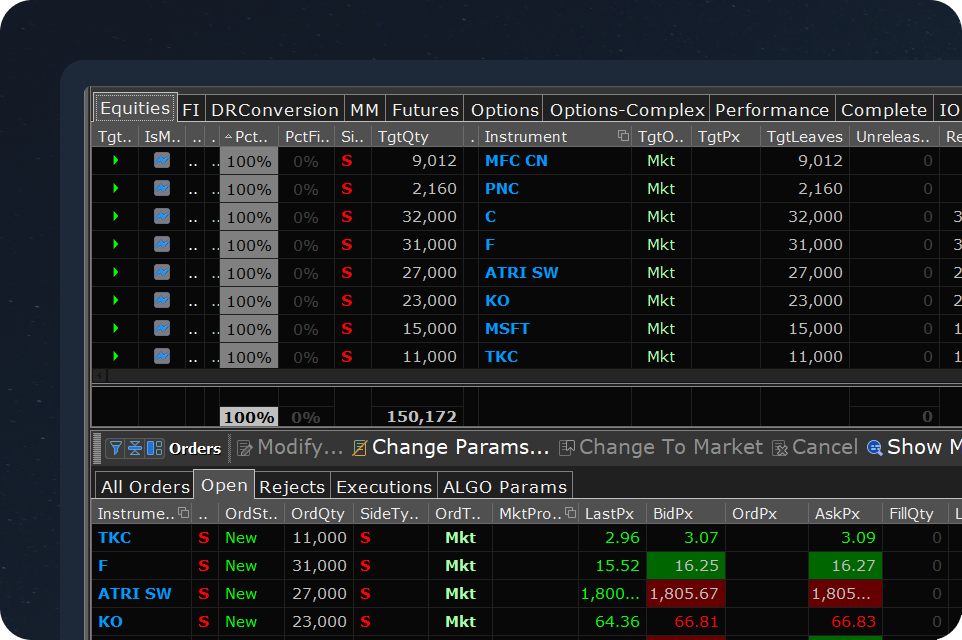

The platform includes an intuitive desktop application that offers real-time monitoring of orders, executions, and positions. It also provides detailed FIX transaction troubleshooting tools and a suite of configuration utilities for system administrators to easily define routing rules and enhance FIX message workflows.

For firms looking to extend their integration, Smart FIXGate delivers a comprehensive set of APIs, supporting multiple programming languages such as Java, C++, .NET, and GRPC frameworks. This wide API coverage includes Python, Ruby, Node.js, Go, Dart, Kotlin, and PHP, making it ideal for in-house development teams and fintech integrators.

Smart FIXGate is easily configurable for drop-copy functionality, allowing it to send its transaction flow to other trading systems or receive third-party drop-copies to reflect external trading activity in its position tracking. It also produces a variety of compliance reports, supports a vast number of inbound and outbound FIX connections, and is capable of handling significant volumes of FIX messages.

- Instantly connect with global trading counterparts.

- Supports equities, futures, options, and FX asset classes.

- Buy-side and sell-side firms achieve faster time to market.

- Pre-trade and real-time risk monitoring.

- Customizable risk rules to comply with regulations.

- Proactive alerting and automated trade blocking.

- Manage multiple FIX sessions with ease.

- Intelligent message routing based on rules.

- Self-service platform reduces IT dependency.

- Scale as your trading volumes grow.

- Supports complex routing scenarios and diverse counterparties.

- Cloud-ready and on-premise deployment options.

Improve Operational Efficiency: Reduce manual workflows and errors.

Accelerate Time to Market: Deploy new FIX connections in minutes

Ensure Regulatory Compliance: Meet MiFID II, SEC, and global standards.

Control Your Trading Infrastructure: Self-managed, customizable platform.

Connectivity

- Multi-asset

- High-throughput and low-latency

- High-availability with Disaster Recovery support

- Normalized flow across multiple FIX versions

- GUI tools for setup, control, and monitoring

- Rule-based routing

- GTC/GTD order warehousing

- Message enrichment

- Instrument resolution based on Security Master

- Calendar-based order handling

- Regulatory compliance reporting

- Sell-short and borrow handling

- Major/minor currency handling

control

- Client risk checks

- Cancel on disconnect

- Connection throttling

- Problem order handling/repair

- Risk limit overrides

- Position tracking

- Customizations and integrations via API

Monitoring of FIX connections and trades

Request Demo

Other products

News & Media

All publicationsReady to assist you in every step

Our high-touch support consists of experienced engineers who know the product, understand your business goals and ensure client solutions are trade-ready in weeks, not months.