Powerful algorithmic trading engine

HFT strategies for equities, futures, options, fixed income, forex, and crypto trading without having to invest the time and resources in building and maintaining your own technology infrastructure.

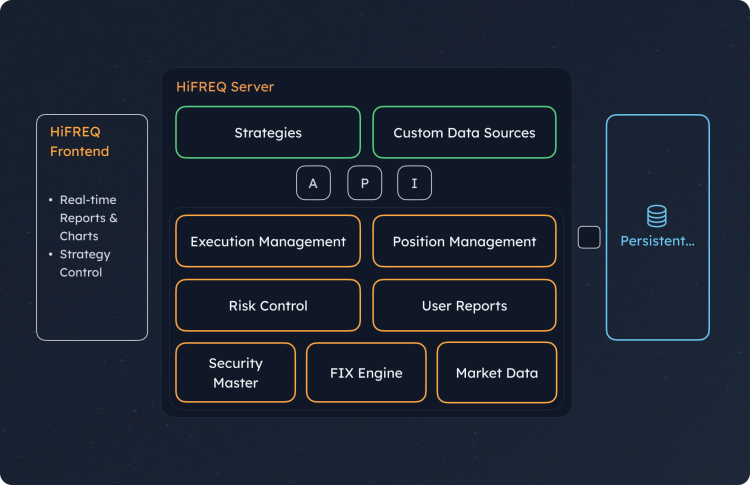

Offers an unprecedented level of functionality and power to trading desks, it also can be configured to deliver just a subset of required features.

Provides all the essential components to facilitate throughput of tens of thousands of orders per second at sub-millisecond latency.

Modular approach facilitates better fault isolation where the failure and recovery of one module does not require the restart of the rest of the system.

It is supported by engineers with 20 years of experience in the industry who know the product and your business needs.

Product features

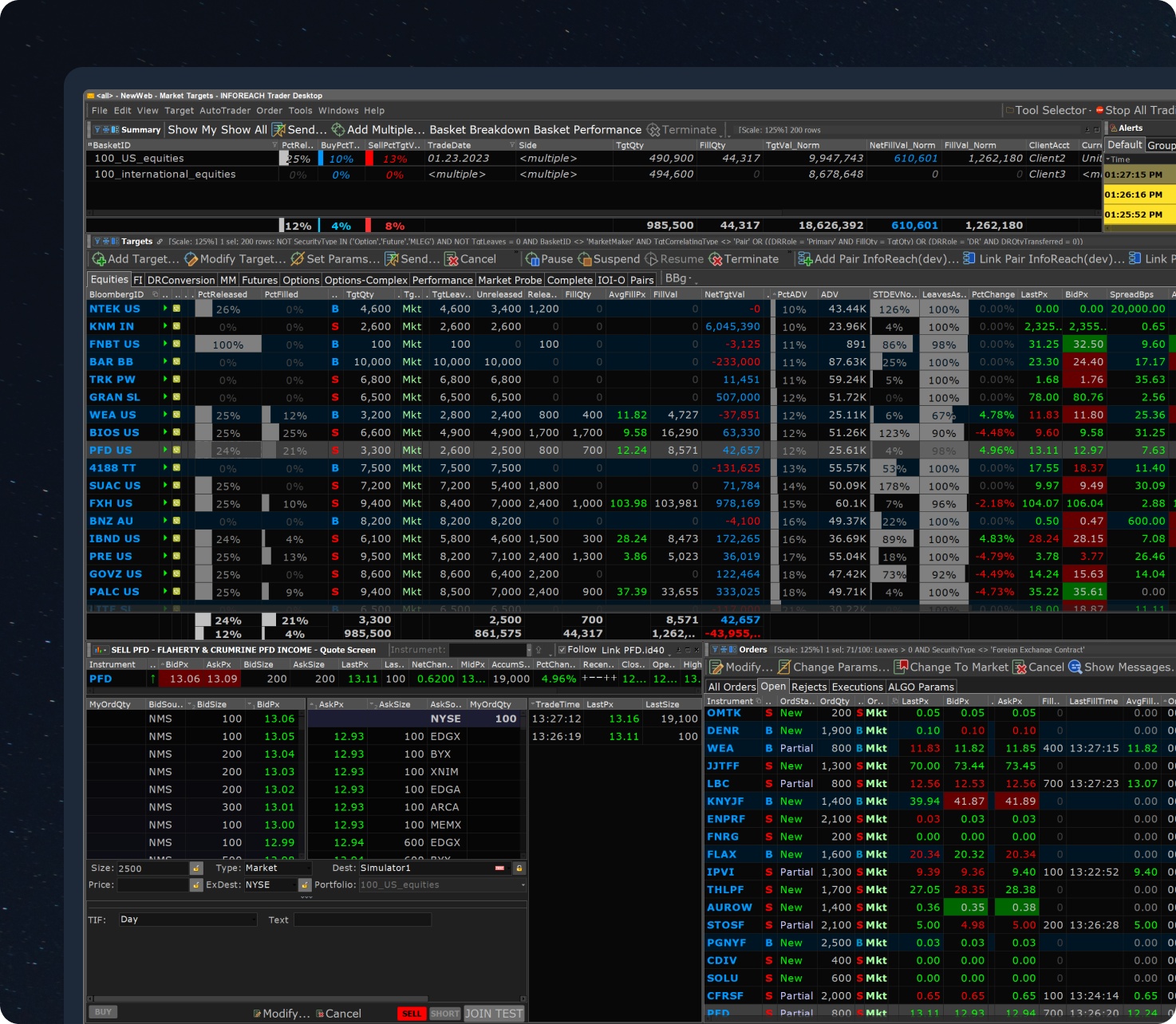

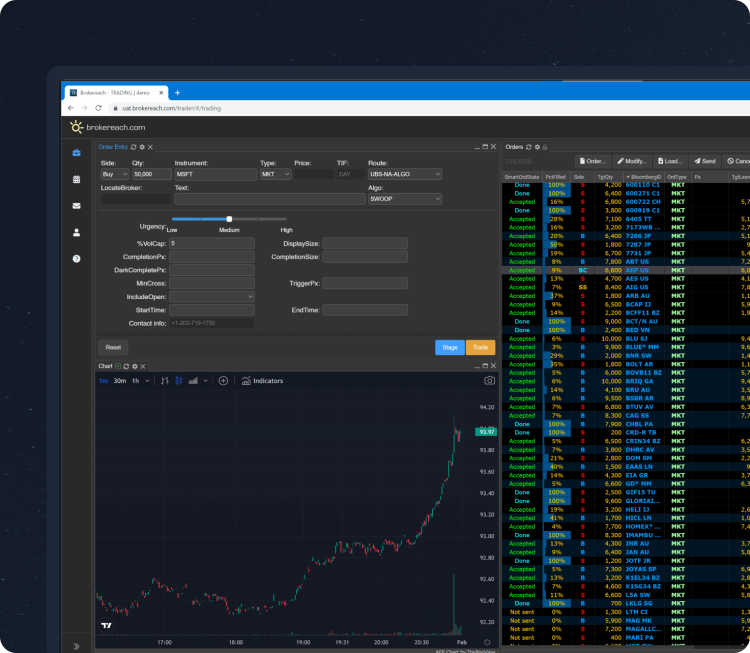

Global equities, futures, options, fixed income,

forex, and crypto

HiFREQ connects you to multiple brokers,

exchanges and ECNs.

HiFREQ can execute 20,000+ orders per second per single FIX connection. Using two or more FIX connections can considerably increase throughput.

To increase the efficiency and performance of the trading strategies their components can be designed to run concurrently. Strategy components can also be deployed across multiple servers that can be collocated with various execution venues.

Risk Control Features

System administrators can configure risk limit checks to apply to a specific user, group of users or all users.

Risk checks can be configured for various custom-defined categories. For example, one can define certain risk check rules.

Risk limit rules can be assigned to specific instruments, all instruments or any instrument within specified Category.

Start-of-day and intraday buys

Start-of-day and intraday sells

Start-of-day and intraday buys minus sells

Start-of-day and intraday buys plus sells

Intraday buys

Ensures the total number of orders sent over a specific time interval does not exceed a pre-set level

Open buys

Open sells

Open buys minus sells

Ensures the total amount traded over a specific interval does not exceed a pre-set level

Validates order limit price against some reference price.

Checks the size of the order against the percentage of the instrument ADV

Open buys plus sells

Checks the size of the order being sent

Ensures the total number of orders sent does not exceed a pre-set level

Intraday sells

Intraday buys minus sells

Limit Unit:

An administrator can use various methods for risk check calculations.

implies that calculation is done based on shares or contracts. For example, Open Long Position may not exceed 1,000,000 shares

implies that calculation is done based on the notional value. For example, Open Short Position cannot exceed 10,000,000 USD

- Percentage – order size check against ADV

- Absolute, Bps, Percentage of Spread, Percentage of Price or Tick – units for Single Order

- Price Away checks

InfoReach detects when trader attempts to send large market orders to the open markets rather to the broker’s desks or algorithms and warns traders of the potential risk.

Currency of the specified risk check.

Other products

News & Media

All publicationsReady to assist you in every step

Our world-class support team is comprised of experienced engineers who know the product, understand your business goals and ensure client solutions are trade-ready in weeks, not months.