Full automation of ETF and forex quotes to Bloomberg users and direct clients, saving you time and human resources

Millisecond-time quote forwarding ensuring your clients receive faster quotes

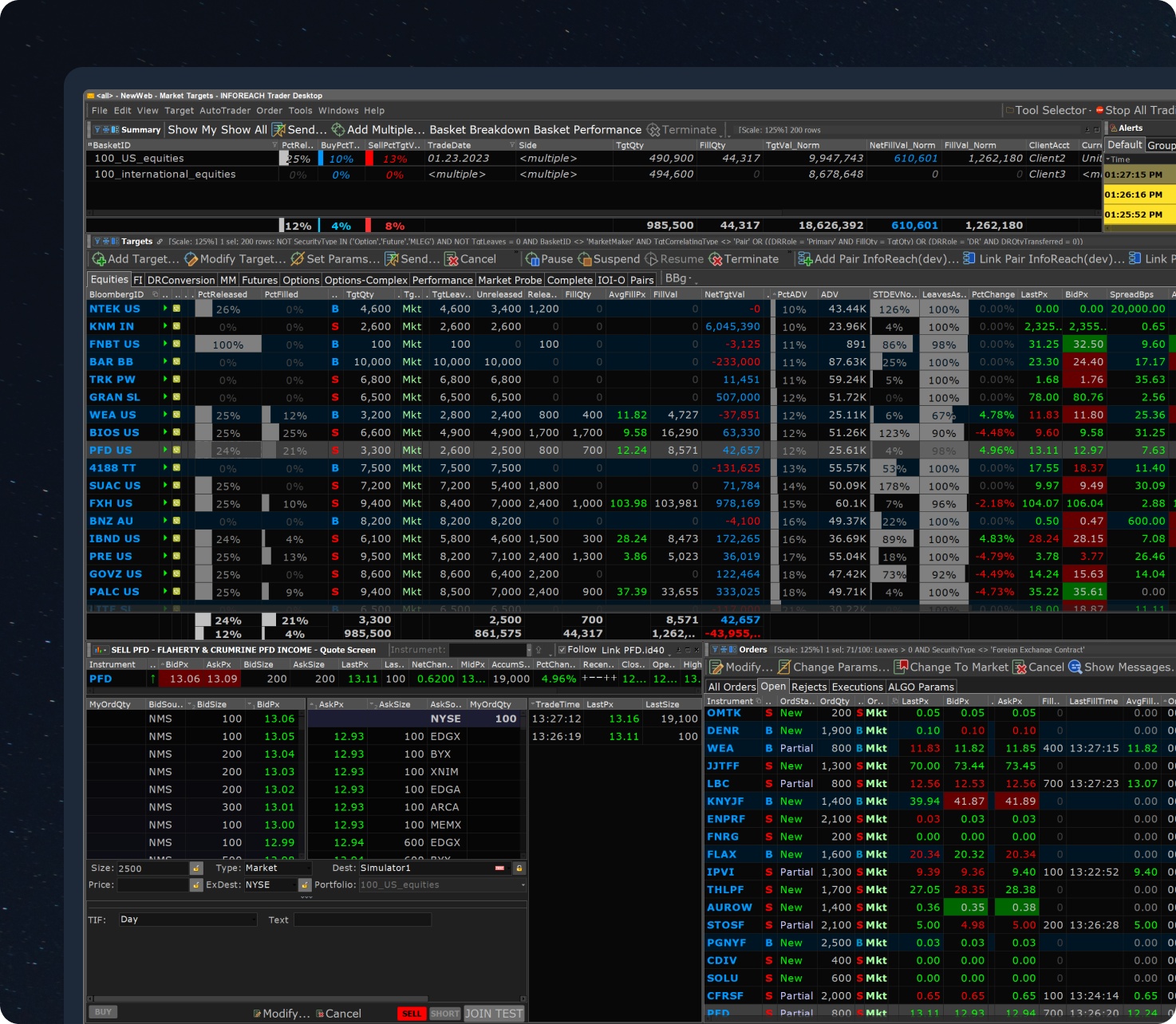

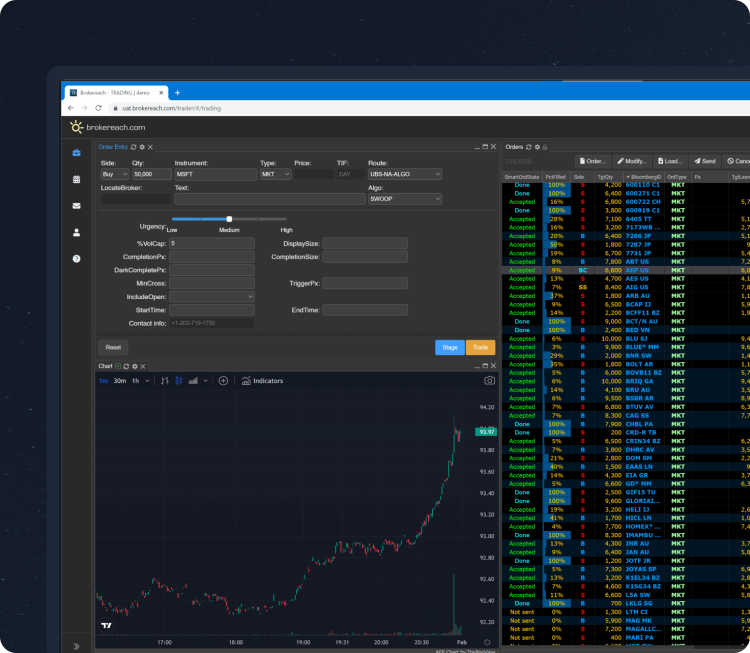

A full suite of monitoring and management tools, providing traders with comprehensive oversight and control

It’s all hosted by InfoReach

RFQ Automation in InfoReach TMS

InfoReach Trade Management System (TMS) features a powerful Request-for-Quote (RFQ) automation algorithm that enables brokers to seamlessly receive RFQs from their clients via Bloomberg or direct FIX connections.

Intelligent Quote Sourcing and Selection

Once an RFQ is received, the algorithm—based on the client’s preferred configuration—automatically queries multiple liquidity sources, such as quote-providing partners and market makers.

Next, it evaluates the returned quotes, selects the best one, applies the appropriate markup if necessary, and forwards it back to the client.

Seamless Order Execution

If the client responds with an order, the same algorithm immediately executes the order against the selected best-quote partner, ensuring a fully automated RFQ-to-trade workflow with minimal latency.

Transition to Full Automation

By replacing manual RFQ handling, this solution eliminates tedious and time-consuming workflows that brokers would otherwise manage by hand.

Furthermore, the algorithm is built for scale and can process a large volume of RFQs in parallel, each within milliseconds, providing both speed and efficiency.

Other products

News & Media

All publicationsReady to assist you in every step

Our high-touch support consists of experienced engineers who know the product, understand your business goals and ensure client solutions are trade-ready in weeks, not months.